At Monthey Capital, we believe in the power of a macroeconomic and value-driven investing strategy to navigate today's complex markets. By harnessing the analytical power of data and financial metrics, we identify undervalued assets poised for growth. Our proven strategy analyzes overarching economic trends and couples them with a keen eye for undervalued assets thereby aiming to uncover opportunities with significant growth potential. This disciplined approach not only minimizes risk but also maximizes returns over the long term. Clients can trust in our commitment to delivering results through a transparent and systematic investment approach. With our macroeconomic and value-driven investing strategy, we strive to provide our clients with a robust framework for achieving long-term financial success in an ever-changing global landscape.

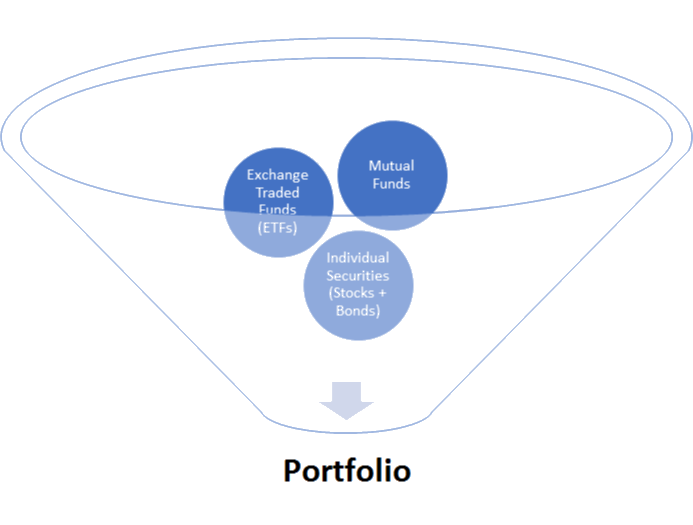

We base the foundation of our portfolio design upon each client’s specific and unique risk profile, using asset allocation strategies for suggested investment allocations. Each portfolio is globally diversified, which uses economic analysis to make tactical shifts away from stated strategic portfolios. Typical tools used to execute on our unique portfolios include granular ETFs and mutual funds which provide access to Canadian, US and Global Equity allocations; Fixed Income Securities, including government, corporate and global instruments; Real Estate; Infrastructure; Commodities, options and derivatives as well as alternative offerings. All securities products are provided through Worldsource Securities Inc., sponsoring investment dealer and member of the Canadian Investment Regulatory Organization (www.ciro.ca), member of the Canadian Investor Protection Fund (www.cipf.ca). For more information please visit www.worldsourcesecurities.com.